The age old question. How much of your income should be going to debt vs investments. Should it be all or nothing?

The answer depends on a variety of factors, one of which being personal preference. In general, investing should be prioritized above LOW interest debt, particularly if you are young. Here are some suggested cut offs:

- Invest first if your debt is less than 6% if in 20s

- Invest first if your debt is less than 5% if in 30s

- Invest first if your debt is less than 4% if in 40s

Above those cut offs, pay off the debt first!

Why does age matter? With age, your portfolio will have a higher bond allocation and generally low returns. In addition, you want the security that complete debt freedom brings when you move into retirement.

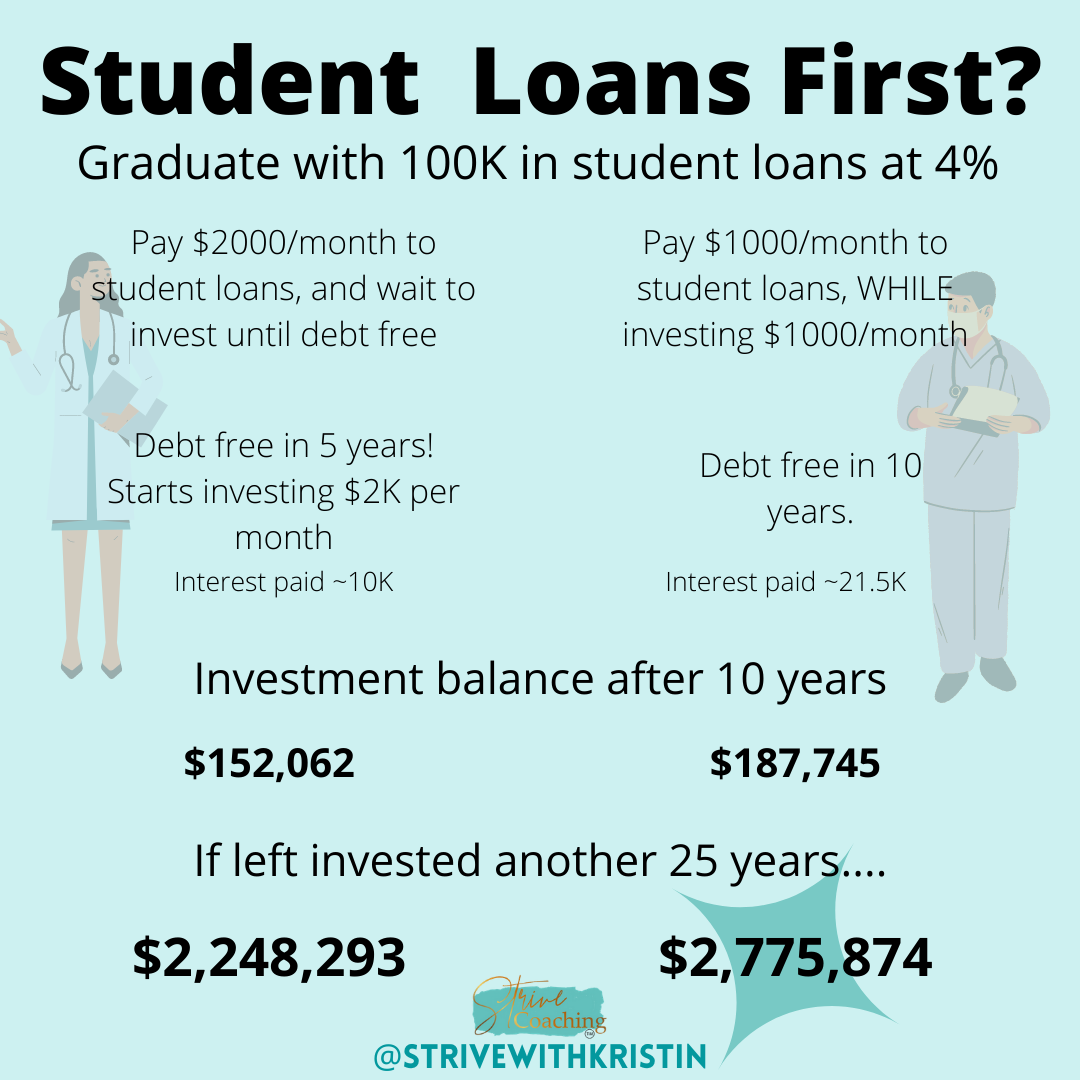

Here are some examples of how the numbers change on the debt vs invest question when looking at high interest vs low interest debt:

With low interest, high dollar student loan debt, your net worth actually comes out higher if you do a combination of investing while paying debt off.

When you look at high interest credit card debt, the situation changes. If you carry credit card debt, pay it off first. The interest rates are astronomical and will cause a major financial drag.

One important factor to note here is that this only looks at the numeric side of the equation. There is substantial peace that comes with being debt free. As a result, you may decide to aggressively pay off debt as fast as possible, and then move on to investing. This is the route we took (aside from our mortgage). If you choose this route, get the debt paid off FAST. Early investing is one of the foundations of building wealth. The longer you wait, the harder it is.

Leave a comment with your plans to approach debt vs investing!

If you’re still trying to navigate creating enough money in your budget to take care of debt AND invest, check out Cashflow Cornerstones. It will put you on the right path.

Kristin Burton, PA

Kristin Burton, PA

Kristin Burton is a pulmonary/critical care PA. Through her crushing experience with student loan debt, she developed a passion for personal finance. She then founded Strive Coaching, a company designed to fundamentally change the way millennials approach money.